Global black swan events, generally considered to be once-in-an-economic-cycle occurrences, have been disrupting investment markets with alarming frequency. In the past few years, we have experienced Brexit, the COVID-19 pandemic and geopolitical conflicts.

The economic uncertainty arising from the US government’s current tariff policies is only the latest in this series of black swan events. The accelerating pace of such events underscores the importance to investors of allocating to assets with stable performance over time.

When Harrison Street entered Europe in 2015, alternative sectors such as purpose-built student accommodation (PBSA) and build-to-rent (BTR) were considered niche real estate asset classes. Other alternatives, such as senior housing, self storage and life sciences were even more nascent. Scalable, institutional-quality opportunities in these sectors were few and far between.

Today, the opposite is true. It is increasingly evident that institutional investors are rotating allocations from commercial sectors towards a wide range of alternative sectors across Europe. These groups have been attracted by relative outperformance, favourable demographic tailwinds, lower volatility and less correlation with economic cycles — particularly in a period of current macroeconomic uncertainty.

A decade ago, the lack of institutional investment in alternative sectors was driven by limited scale for investment, but also inadequate performance data to support investment decisions and a lack of knowledge of how these assets perform during difficult economic times. We believe the continued rotation towards alternative sectors suggests that these issues have been overcome, and Harrison Street can now point towards two decades of operational real estate data to demonstrate this.

We believe investors’ interest in alternative real estate assets that offer resilience and durable income will accelerate even further in the current economic uncertainty, building on the momentum we have seen during the past decade.

Opportunity for core

While these sectors remain highly fragmented with high barriers to entry, the current state of these sectors in Europe resembles the opportunity seen in the United States some 10 to 20 years ago.

Many of the alternative sectors have now reached a critical scale, with a greater number of opportunities across the investment spectrum to invest in, or develop, institutional-quality real assets in a number of European markets. A marked increase in development during that time frame has boosted liquidity, as alternative real estate sectors’ share of total European real estate investment increased from 8.7 percent in 2006 to 28.5 percent in 2024, according to JLL. Alternative portfolio composition that once relied on ground-up development of assets can now be achieved by acquiring stabilised assets across selective markets.

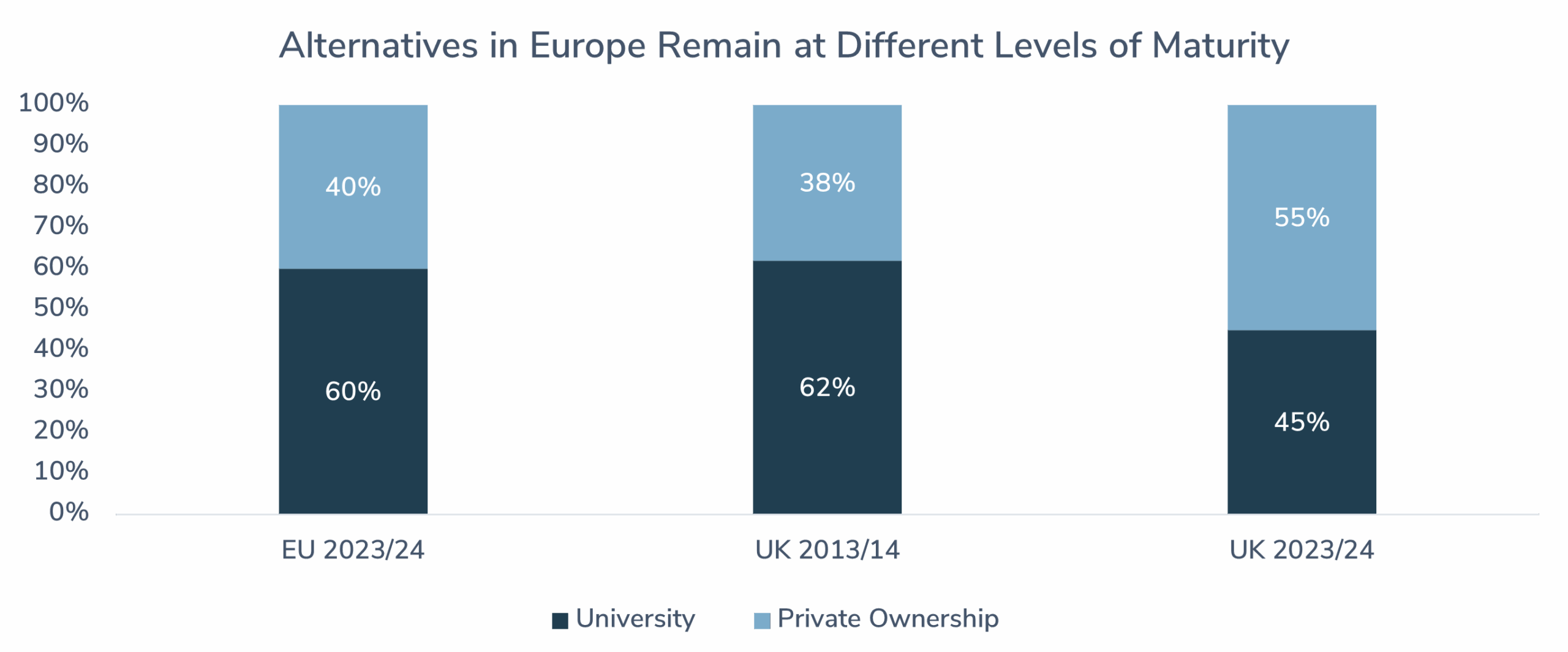

Due to this increased activity, select alternative sectors in Europe now have a deeper investable universe. It is estimated by JLL that there are currently 5 million institutional-owned private multifamily homes and an additional1 million private PBSA beds across Europe. However, the opportunity to invest in Europe is not equal. The United Kingdom has led the way for the development of institutional- quality alternative assets across these sectors. This is well illustrated in the student housing sector, where current private student housing levels in Europe are similar to UK student housing ownership a decade ago. Since then, almost 220,000 PBSA beds have been added to the UK PBSA stock, of which 93 percent are privately owned, says Green Street.

These data suggest certain sectors have matured to the point that a significant opportunity exists for specialist alternative investment managers with a strong track record in these segments to create a diversified portfolio of high-quality, stabilised alternative real estate assets across major European markets.

In response, Harrison Street has launched the first pure-play core alternative real estate strategy in Europe. We believe 2025 is an attractive entry point for investors to pursue the creation of such a strategy, as the current market dislocation that has arisen from challenging capital market conditions has led to significant repricing int he past two years, providing an opportunity to acquire well-performing, core alternative assets at an attractive basis discount and at scale. We believe this creates an opportunity to drive outsized near-term returns, particularly while there is lower competition from other investors.

Rise of new alternatives

Other emerging alternative sectors such as senior housing, self storage and digital have been underpinned by similarly strong fundamentals, but have remained relatively underinvested in Europe. Having tracked these sectors in Europe for a number of years, we believe 2025 will provide an exceptional opportunity to move towards the next phase of alternative real estate investment in Europe.

A compelling investment proposition for European alternative real estate is being driven by current demographic trends and supply/demand dynamics.

Europe’s frequently discussed demographic shift is its fast-ageing population, with Eurostat figures estimating the75-plus age cohort will increase by 10.8 million individuals by 2035 (+23 percent). The “baby boomer” segment also has emerged as the wealthiest age group in Europe, and their expectations for quality in housing and health services will likely match their ability to pay for those things, says Eurostat. This shift provides a compelling investment opportunity in a sector that already has record occupancy rates and has demonstrated years of strong income growth. This rising demand, along with constrained supply, is why senior housing is among some of the highest-conviction investment strategies in the near term, as well as other living sectors such as student housing, where demographic trends are forecast to be favourable in the years ahead.

Favourable macroeconomics

While there are compelling reasons to remain bullish on the United Kingdom’s real estate fundamentals, the ECB’s loosening of monetary policy in the past year skews the near-term opportunity to continental Europe.

Due to a weaker economic outlook as a result of global trade uncertainty, financial markets now expect Europe’s central banks to be more aggressive in cutting interest rates than previously anticipated. The ECB cut its benchmark interest rate by 25 basis points to 2.25 percent on 17 April, its seventh rate cut in the past year, as rates have fallen by a cumulative 175 basis points since May 2024, and has warned that tariffs may necessitate even more policy easing in the months ahead.

While the Bank of England (BoE) followed course on 8 May, cutting interest rates by a quarter point to 4.25 percent, swap rates in the euro zone are still almost 170 basis points lower than in the United Kingdom, according to Chatham Financial.

All-in financing for core alternative opportunities in the euro zone are now accretive, while leverage remains neutral to slightly accretive for some UK alternative sectors.

Why now?

The substantial repricing of European alternatives since 2022, coupled with near-record lows of new delivery and starts, and strong demand for these product types, has created an extremely compelling investment opportunity in the next 12 to 18 months.

The continued growth and evolution of alternative asset classes presents a true opportunity for investors to invest in areas of the real estate market that can be safe havens during times of disruption, as they have demonstrated resilience and security of income through economic cycles and multiple black swan events, including Brexit, the COVID-19 crisis and war in Europe.

We believe 2025 is set to be an exceptional vintage for European alternative investment, but the current environment necessitates precise navigation, as sector and market selection becomes increasingly important as we enter the next cycle.

While high barriers to entry remain and operational expertise is required, we believe European alternatives represent an outsized opportunity, as investors seek to diversify their portfolios against the volatile conditions that lie ahead.

*Originally published in Institutional Real Estate, Inc. (IREI) Europe

Figure Source: Green Street. Data as of May 2025.